When foreign investors invest in Vietnam, they could establish company in Vietnam. Foreign investors have the right to choose the appropriate forms of enterprise such as a limited liability company, joint stock company, etc.

Why Foreign Investors Invest and Establish a Company in Vietnam?

Vietnam offers a compelling environment for foreign investors seeking to establish company in Vietnam. There are several reasons why investors should consider Vietnam as their business destination.

Firstly, Vietnam boasts a rapidly growing economy, characterized by robust GDP growth and a favorable business climate. The country has implemented various market-oriented reforms, attracting foreign investment and fostering a dynamic entrepreneurial ecosystem.

Additionally, Vietnam benefits from a strategic geographical location, serving as a gateway to the vibrant markets of Southeast Asia. Its membership in regional trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the ASEAN Economic Community (AEC), provides investors with access to a vast consumer base and favorable trade conditions.

Furthermore, Vietnam offers a young and skilled workforce, with competitive labor costs, making it an attractive destination for manufacturing and service industries. The government has also taken steps to enhance transparency, streamline administrative procedures, and improve investor protection, demonstrating its commitment to facilitating business operations.

Overall, Vietnam presents a promising investment landscape, offering market potential, strategic advantages, and a supportive business and legal environment for investors seeking to establish a company in Vietnam.

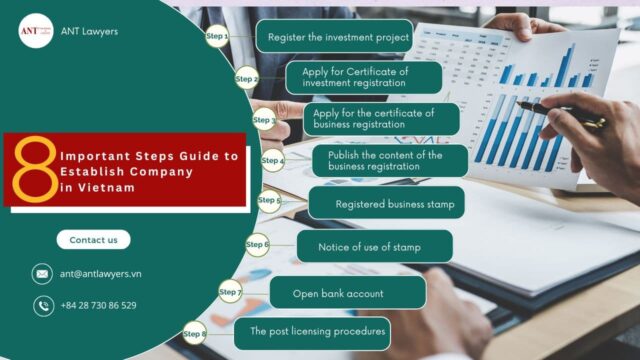

8 Important Steps Guide to Establish Company in Vietnam

Step by step to set up company in Vietnam

Step 1: Register the investment project

Step 2: Apply for Certificate of investment registration

Step 3: Apply for the certificate of business registration

Step 4: Publish the content of the business registration

Step 5: Registered business stamp

Step 6: Notice of use of stamp

Step 7: Open bank account

Step 8: The post licensing procedures

How to Establish Company in Vietnam?

Step 1: Register the Investment Project to Establish Company in Vietnam

Investors submit an investment project registration file to the Business Registration office of the province or city or the management board of an industrial zone, an export processing zone or a high-tech zone for the approval of an investment project during the period within 15 days (without time for clarification).

Step 2: Apply for Certificate of Investment Registration

After approval of the investment project, investors submit a valid record to the Department of Planning and Investment within 10 days to apply for a business registration certificate in Vietnam.

Step 3: Apply for the Certificate of Business Registration

After obtaining the business registration certificate, the investor shall submit the application for enterprise registration certificate to the enterprise registration office within 3 days.

Step 4: Publish the Content of the Business Registration

After being granted the certificate of enterprise registration, the investor shall disclose information about the enterprise on the national enterprise registration portal within 30 days, including the following information:

i, Business lines;

ii, List of founding shareholders and shareholders being foreign investors for joint-stock companies.

Step 5: Registered Business Stamp

The enterprise has the right to decide on the form, quantity and contents of the stamp of the enterprise. The content of the stamp must show the following information:

-Company’s name;

-Business code.

After receiving the legal entity stamp and before using the business stamp, the enterprise must send a notice on the stamp of the enterprise to the business registration office for publication in the National Information Portal on the business registration.

Step 6: Notice of Use of Stamp

After having stamp made, investors submit notices on use of stamp forms to the Investment registration agency. After receiving the record, the Investment registration agency issues a receipt for the enterprise, publishes the notice of the enterprise on the National Business Information Portal and issues a notice of the posting, stamp samples of enterprises, branches and representative offices for enterprises.

Step 7: Open Bank Account

Investors need to open two types of bank accounts, namely the investment capital account to receive the investment amount and the transaction account for conducting daily transaction in Vietnam.

Step 8: The Post Licensing Procedures

For the conditional business lines:

Investors investing in conditional businesses lines as must apply certificate of business qualification, practicing certificates, professional liability insurance, legal capital requirements, etc. before conducting business in Vietnam.

FAQ: Establish company in Vietnam

Q1: What does it mean to establish company in Vietnam?

A: To establish company in Vietnam means to legally form a business entity, such as an LLC, joint-stock company, or partnership, through official registration, licensing, and compliance with Vietnamese laws and regulations.

Q2: Who can establish company in Vietnam?

A: Both foreign investors and Vietnamese nationals can establish company in Vietnam. Foreigners typically pursue a process involving an Investment Registration Certificate (IRC) followed by an Enterprise Registration Certificate (ERC).

Q3: What are the main steps to establish company in Vietnam?

A: The process to establish company in Vietnam generally includes:

- Registering the investment project.

- Applying for the Investment Registration Certificate (IRC).

- Applying for the Enterprise Registration Certificate (ERC).

- Publishing business information on the National Enterprise Registration Portal.

- Registering and notifying about the company seal/stamp.

- Opening corporate bank accounts (capital and transaction accounts).

- Completing post‑licensing procedures (tax, VAT, professional certificates for conditional sectors).

Q4: How long does it take to establish company in Vietnam?

A: Typically around 30 to 60 days, depending on the complexity and whether your business is in a conditional sector.

- IRC issuance: about 20 working days.

- ERC issuance: usually within 5 – 7 working days.

Q5: What documents are required to establish company in Vietnam?

A: You’ll need:

- Project dossier: investment registration, financial capacity report, company charter, list of members.

- ID (passport, etc.) for individuals; corporate documents for legal entity investors, all notarized, translated, legalized.

- Lease agreement for the company’s registered office.

- Power of attorney, if using a representative.

Q6: Which business structure is most common when you establish company in Vietnam?

A: The Limited Liability Company (LLC) is the most popular choice which allows 100% foreign ownership in many sectors, limits liability to contributed capital, and is administratively simpler than a joint-stock company.

Q7: What’s the difference between conditional and non-conditional investment when you establish company in Vietnam?

A:

- Non-conditional sectors: Open to foreign investors with standard licenses, easier to establish company in Vietnam.

- Conditional sectors (e.g., real estate, finance): Require additional approvals, licensing, and may significantly delay the process.

Q8: Can operations begin before the bank account is open, when setting up to establish company in Vietnam?

A: Yes, operations can begin once the IRC and ERC are granted. However, to legally receive revenue or investment capital, a corporate Vietnamese bank account must be opened.

Q9: What are common mistakes when foreign investors establish company in Vietnam?

A: Avoid pitfalls by not:

- Skipping document legalizations (notarization, translation, consularization).

- Misclassifying your business as non-conditional when it’s actually conditional.

- Underestimating timeline for bank opening or expecting cash capital contribution (must be via bank transfer).

- Neglecting post-licensing steps like publishing registration, tax code, VAT.

Q10: Do timelines vary by city when you establish company in Vietnam?

A: Absolutely. While the framework is national, administrative efficiency varies between provinces, Hanoi, Da Nang and Ho Chi Minh City tend to be faster than more remote areas. Between those key cities, there might be different priorities to attract investments hence the project explanation at the application of dossiers might be different.

How a Law Firm in Vietnam Could Help Establish Company in Vietnam?

Establishing a company in Vietnam requires careful adherence to these steps and compliance with relevant regulations, particularly for businesses with conditional requirements.

The above outlines the process to establish company in Vietnam for foreign investors. By engaging the services of a reliable law firm in Vietnam, investors can navigate through these steps efficiently and ensure compliance with legal requirements, ultimately facilitating a smooth and successful establishment of their business in the country.

About ANT Lawyers, a Law Firm in Vietnam

We help clients overcome cultural barriers and achieve their strategic and financial outcomes, while ensuring the best interest protection, risk mitigation and regulatory compliance. ANT Lawyers has lawyers in Ho Chi Minh city, Hanoi, and Danang, and will help customers in doing business in Vietnam.

Setting up trading company in Vietnam

10 questions to ask before setting up company in Vietnam

Vietnam Company Formation. How to proceed?

5 Powerful Steps to Register Company in Vietnam: Seizing Opportunities in a Growing Market

How Foreign Entity Could Set-up Representative Office in Vietnam?

From Compliance to Excellence – Corporate Governance Lawyers in Vietnam

How ANT Lawyers Could Help Your Business?

You could reach ANT Lawyers for advice via email ant@antlawyers.vn or call our office at (+84) 24 730 86 529